For businesses and engineers worldwide, China plastic injection molding is synonymous with manufacturing scale and competitive cost. However, the narrative has evolved from seeking the lowest price to securing high-quality, reliable production. This guide moves beyond stereotypes to provide a clear-eyed, expert analysis of sourcing plastic injection molding in China. We'll explore the modern ecosystem, dissect quality and logistics, and offer actionable strategies for vetting partners. Whether you're launching a new product or scaling production, this guide will equip you with the knowledge to navigate this complex market and achieve manufacturing success.

Why Choose China for Plastic Injection Molding?

The decision to source from China is strategic, driven by a combination of mature capabilities and economic factors.

- Unmatched Supply Chain Depth: China hosts the world's most concentrated and comprehensive ecosystem for plastics manufacturing. This includes not just molders, but also specialized tooling shops, raw material suppliers, and providers of secondary operations (painting, assembly, packaging). This vertical integration streamlines production and problem-solving.

- Advanced Technical Capabilities: Leading Chinese manufacturers operate state-of-the-art facilities with high-precision injection molding machines (from brands like Haitian, Engel, and Arburg), robotic automation, and sophisticated quality control labs. Many are proficient in complex processes like multi-shot molding, gas-assist molding, and working with engineering-grade resins.

- Significant Cost Advantages: While labor arbitrage has narrowed, the primary cost savings now come from economies of scale, highly efficient supply chains, and competitive pricing for injection mold tooling. Production mold costs in China can be 30-50% lower than in North America or Europe, fundamentally changing the unit economics for medium to high-volume projects.

- Scalability and Speed: The density of the manufacturing base allows for rapid scaling. A factory can often shift production between multiple facilities or lines to meet spikes in demand, offering unparalleled flexibility for growing businesses.

How Does the Chinese Supply Chain Work?

Understanding the structure is key to effective navigation. The landscape is tiered, offering different value propositions.

| Tier Type | Typical Profile | Best For | Key Considerations |

|---|---|---|---|

| Large, Integrated Factories | Often serve global brands, have in-house mold making, full assembly lines, and export departments. | High-volume, turnkey projects requiring consistent quality and full service. | Can have higher MOQs; less flexible for very small batches. Communication may be more formalized. |

| Specialized Mid-Sized Molders | Focus on specific industries (medical, automotive) or processes (thin-wall, LSR). Highly technical. | Complex parts requiring niche expertise and higher level of engineering collaboration. | Offer strong technical partnership. May outsource tooling to trusted partners. |

| Smaller Job Shops | Agile operations, often family-run, with strong hustle and flexibility. | Lower volume projects, prototyping, and simpler parts where cost is the primary driver. | Quality systems can vary widely. Requires very diligent vetting and on-site presence/3rd party inspection. |

The workflow typically follows: RFQ & Design Review > Mold Design & Fabrication > Prototype/Sample Approval > Production > QC & Inspection > Packaging & Shipping. A critical success factor is having a clear single point of contact (a project manager or sales engineer) who can coordinate across these internal and external links in the supply chain.

What Quality Standards Are Followed?

The phrase "Chinese quality" is outdated. Quality is defined by the specific standards a factory implements and adheres to.

- International Certifications: Reputable molders hold globally recognized certifications. ISO 9001 for quality management is a baseline. For regulated industries, look for IATF 16949 (automotive) and ISO 13485 (medical devices). These are not just certificates on the wall; they mandate documented processes for design control, production, and corrective action.

- Process Control: Leading factories employ Scientific Molding principles. This involves establishing and meticulously documenting the critical process parameters (temperature, pressure, time, speed) for each mold. This data-driven approach ensures repeatability and allows for troubleshooting based on evidence, not intuition.

- Inspection & Measurement: Expect the use of First Article Inspection (FAI) with detailed reports, Coordinate Measuring Machines (CMM) for dimensional validation, and statistical process control (SPC) charts monitoring key part characteristics during a production run. The best suppliers will provide this data transparently.

- Cultural Shift: There is a growing cohort of Chinese manufacturers who compete on quality and innovation, not just price. They invest in German/Japanese machines, hire Western-trained engineers, and build long-term partnerships based on delivering zero-defect parts.

How to Vet a Chinese Injection Molder?

Due diligence is your most important task. A systematic approach separates true partners from order-takers.

- Deep-Dive on Capabilities: Request a detailed company profile, machine list (make, model, tonnage), and photos/videos of the production floor. Ask about their experience with your specific material (e.g., PEEK, LSR) and part complexity.

- Verify Certifications & Audit Reports: Ask for valid certificates and, if possible, recent audit reports from other international clients. A factory comfortable sharing this is confident in its systems.

- Request Client References & Sample Parts: Ask for 2-3 references from companies in your region or industry. Crucially, request physical sample parts they have produced—you can assess the quality firsthand.

- Conduct a Virtual or On-Site Audit: A video call walkthrough of the facility is now a standard and effective vetting tool. Focus on the tool room, quality lab, and production floor organization (5S). For high-value projects, an on-site audit by you or a third-party agency is indispensable.

- Assess Communication & Transparency: Gauge their responsiveness, English proficiency of the engineering team, and willingness to engage in Design for Manufacturability (DFM) discussions before you place an order. Hesitancy to provide technical feedback is a red flag.

Tooling Options: Local vs. Export Molds

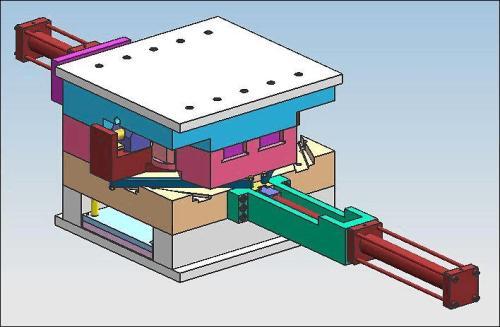

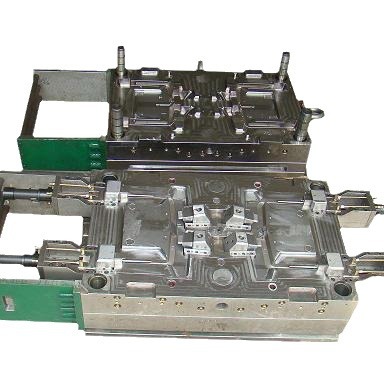

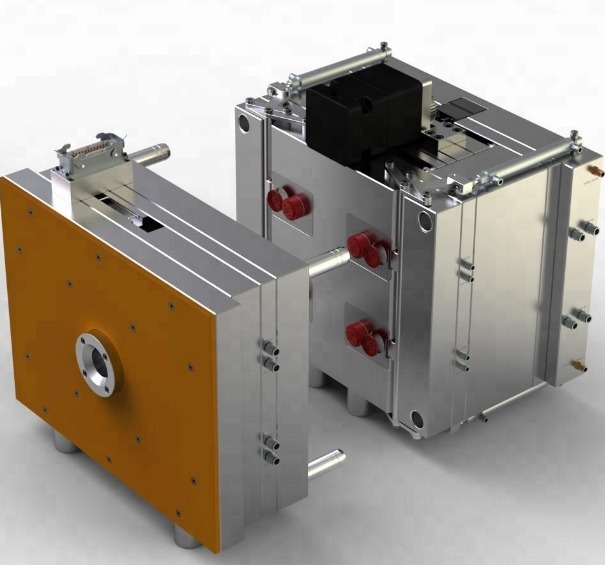

The mold is your most critical asset. The choice between a "local" mold and an "export quality" mold has long-term implications.

| Characteristic | Local/Chinese Standard Mold | Export Quality Mold |

|---|---|---|

| Primary Goal | Lowest upfront cost. | Longevity, reliability, and ease of maintenance. |

| Mold Base & Materials | Often uses local-standard mold bases (LKM). Cavities/cores may use lower-grade steels (e.g., P20 pre-hardened). | Uses international standard bases (DME, HASCO, MISUMI). Cavities/cores use high-grade, hardened steels (e.g., H13, S136) for wear and corrosion resistance. |

| Engineering & Finish | Basic cooling, standard tolerances. May have simpler ejection systems. | Optimized conformal cooling channels, tighter machining tolerances, detailed surface finishes (polish/texture), robust ejection. |

| Lifespan | 100,000 - 500,000 shots, depending on material. | 1,000,000+ shots possible with proper maintenance. |

| Maintenance & Repairs | May be difficult to service outside of China due to non-standard parts. | Designed for global serviceability with standard components. |

| Best For | Short product life cycles, market testing, or very cost-sensitive projects. | Established products, high-volume production, critical parts, or when future mold relocation is possible. |

Expert Recommendation: For any part destined for sustained production, invest in an export quality mold. The higher initial cost (often 25-50% more) is amortized over a much longer life, yields better part quality and consistency, and protects your intellectual property and production schedule. Insist on a detailed mold design review and steel certification.

How Are Prototyping and Pilot Runs Handled?

A phased approach mitigates risk before committing to full production tooling.

- Digital Prototyping (DFM): The process should always start with a thorough Design for Manufacturability analysis from the molder. They will provide annotated feedback on wall thickness, draft, gate location, and potential sink marks.

- Soft Tooling / Prototype Molds: For functional testing, a low-cost aluminum prototype mold can be machined. This allows you to produce 50-500 parts using the actual production material and process, validating fit, form, and function before investing in hard steel.

- T1 Sample from Production Mold: The first shots from the finished production mold are critical. Plan for a formal First Article Inspection process. The molder should send samples, a full inspection report, and a dimensional layout. Do not approve mass production until you physically have and approve these samples.

- Pilot Run: A controlled production run of 500-5,000 units validates the full manufacturing process, packaging, and logistics chain before ramping to full volume.

Logistics, Duties, and Total Landed Cost

The quoted piece price is only part of the story. Total Landed Cost is what matters.

- Logistics: Options include air freight (fast, very expensive), sea freight (slow, economical), and express courier (DHL, FedEx for samples). For volume, sea freight in containers is standard. Factor in port fees, customs clearance in your country, and last-mile delivery.

- Duties and Tariffs: Duties are based on the Harmonized System (HS) code of your product and its country of origin. The value declared is typically the cost of the goods plus shipping and insurance (CIF value). Consult a customs broker for precise rates, which can vary (e.g., the U.S. has separate rates for plastics from China).

- The Total Landed Cost Formula:

(Unit Price x Quantity) + Tooling Amortization + Shipping + Insurance + Import Duties + Tariffs + Customs Broker Fees + Inland Freight = Total Landed Cost

Always model this completely to make an accurate comparison with local sourcing.

Case Studies: High-Quality Parts Made in China

Case 1: Medical Device Connector

A European med-tech company needed a complex, miniature connector from biocompatible PEEK. Tolerances were under ±0.025mm. They partnered with a Shenzhen-based molder specializing in micro-molding and certified to ISO 13485. The molder used a Swiss-made machine with micro-injection capabilities and a high-precision, hardened steel mold with vacuum venting. The result was a zero-defect part that passed all clinical validation tests, at a cost that made the single-use device commercially viable.

Case 2: Automotive LED Lighting Lens

A North American automotive tier-1 supplier sourced a large, optically clear polycarbonate lens for a headlamp. The challenge was achieving a Class A optical surface free of voids, splay, or sink marks. The Chinese molder, certified to IATF 16949, utilized a mold with thermally controlled surfaces and a dedicated cleanroom injection cell. They implemented a scientific molding process to control every parameter, delivering lenses that met stringent automotive durability and optical standards, enabling the OEM to meet its cost targets for the vehicle platform.

Conclusion

Sourcing China plastic injection molding in the 2020s is a nuanced endeavor that rewards preparation and partnership. It offers compelling advantages in cost, capability, and scale but requires a disciplined approach to quality assurance, communication, and total cost management. By moving beyond price-centric thinking, thoroughly vetting partners based on their systems and expertise, and strategically managing the tooling and logistics pipeline, companies can successfully leverage Chinese manufacturing to produce high-quality plastic parts that compete on the global stage. The goal is not to find the cheapest supplier, but the most capable and reliable partner for your specific project.

FAQ

What are the payment terms typically used with Chinese molders?

A common and balanced structure is: 50% deposit upon order placement (for tooling or production), 40% upon sample approval, and 10% before shipment. For new partners, using Letters of Credit (LC) or secure payment platforms like PayPal (for smaller amounts) adds protection. Never use 100% upfront payment.

How can I protect my intellectual property (IP) when manufacturing in China?

Protection is multi-layered: 1) Sign a comprehensive Non-Disclosure Agreement (NDA) and manufacturing contract with clear IP clauses. 2) Register your designs and patents in China. 3) For tooling, specify an "Export Quality Mold" owned by you, with the contract stating it cannot be used for other clients. 4) Control sensitive components by sourcing them yourself and having the factory only do assembly.

What is the minimum order quantity (MOQ) for production in China?

MOQs vary widely. For injection molding, a typical production MOQ might be 5,000 to 50,000 pieces, depending on part size and complexity. This is to amortize the mold cost and setup time. For lower volumes, discuss "bridge tooling" (aluminum molds) or find a molder with a flexible, low-MoC business model.

Is communication and language a significant barrier?

It can be, but the barrier has lowered considerably. Reputable, export-focused factories employ project managers and engineers with strong technical English skills. Using clear drawings, 3D models, and standardized documentation (like AIAG PPAP for automotive) minimizes misunderstandings. Daily communication via WeChat or email is standard.

What happens if there is a quality issue with a shipment?

This is why vetting and contracts are critical. A professional contract should outline a clear process for quality claims, including timelines for notification, evidence submission (photos, videos), and resolutions (rework, replacement, or credit). Building a buffer of safety stock and conducting pre-shipment inspections are prudent risk-mitigation steps.

Contact Yigu Technology for Custom Manufacturing.

Navigating the complexities of China plastic injection molding requires a partner you can trust. Yigu Technology operates at the forefront of this industry, combining deep local manufacturing expertise with a unwavering commitment to international quality and transparency. We specialize in guiding clients from DFM and prototyping through to high-volume production with export-quality tooling. Our certified processes, advanced engineering support, and integrated supply chain management ensure your project's success from the first sketch to the final delivered part. Contact Yigu Technology today to discuss how we can be your reliable, high-quality manufacturing partner in China.