CNC industries encompass the entire ecosystem of computer numerical control (CNC) technology, including manufacturing, application sectors, tooling, and service providers that leverage CNC machines to drive precision, efficiency, and scalability. As a backbone of modern manufacturing, CNC industries support a diverse range of sectors, from automotive and aerospace to medical devices and consumer electronics. This guide is tailored for industry professionals, investors, manufacturers, and stakeholders seeking a deep understanding of CNC industries—covering key application sectors, market dynamics, technological advancements, core players, and future trends. We integrate verifiable market data, real-world case studies, and expert insights to highlight how CNC industries shape global manufacturing and drive innovation across sectors.

Understanding CNC Industries: Core Definition & Ecosystem

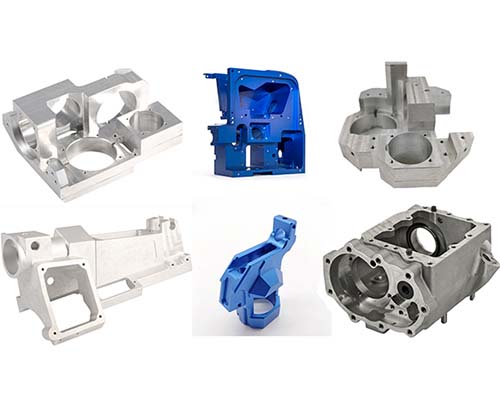

At its core, CNC industries refer to the collective of industries that design, produce, or utilize CNC machines and related technologies (e.g., CAD/CAM software, tooling, automation systems) for material processing. The ecosystem of CNC industries is multi-faceted, comprising three key segments:

- CNC Manufacturing Sector: Companies that design and produce CNC machines (e.g., lathes, mills, routers, punch presses) and related components (tooling, controllers, motors). Key players include Trumpf, Amada, Mazak, and Jyoti CNC Automation Limited.

- CNC Application Sectors: Industries that adopt CNC technology for production, such as automotive, aerospace, medical, and construction. These sectors rely on CNC industries to deliver precision parts and scale production.

- CNC Support Services: Providers of CAD/CAM programming, maintenance, training, and contract manufacturing services that enable seamless integration of CNC technology across industries.

Industry Insight: According to a 2026 report by Grand View Research, the global CNC industries market size is projected to reach $189.7 billion by 2030, growing at a CAGR of 6.2% from 2026 to 2030. The growth is driven by increasing demand for precision manufacturing in aerospace and medical sectors, rising adoption of automation, and expansion of automotive production in emerging economies.

Top 10 Industries Dependent on CNC Industries (2026)

CNC industries are integral to the operations of numerous sectors, enabling them to meet strict quality standards, scale production, and innovate product designs. Below are the top 10 industries that rely heavily on CNC industries, along with their key applications, adopted CNC technologies, and real-world case studies:

1. Automotive Industry

The automotive industry is the largest consumer of CNC industries solutions, leveraging CNC machines for high-volume production of precision components. Key applications include machining engine blocks, transmission parts, chassis components, and body panels.

Key Details: Adopted CNC Technologies: CNC lathes, milling machines, punch presses, and 5-axis machining centers.Market Impact: According to the International Organization of Motor Vehicle Manufacturers (OICA), the automotive sector accounts for 35% of global CNC industries revenue.Case Study: A leading global automaker partnered with a CNC industries provider to implement automated CNC milling lines for electric vehicle (EV) battery enclosures. The solution reduced production time by 40%, improved part accuracy to ±0.002 inches, and supported a 50% increase in EV production volume.

2. Aerospace & Defense Industry

The aerospace & defense sector demands ultra-precision and reliability, making CNC industries a critical enabler. CNC machines are used to process high-strength materials (titanium, Inconel) for aircraft components, missile parts, and satellite structures.

Key Details: Adopted CNC Technologies: 5-axis CNC machining centers, wire EDM machines, and CNC routers for composite materials.Stringent Requirements: Parts must meet AS9100 quality standards, requiring CNC industries solutions with tolerances as tight as ±0.0005 inches.Case Study: A major aerospace manufacturer used 5-axis CNC machines from a CNC industries leader to produce aircraft turbine blades. The CNC solution reduced material waste by 30% and increased blade production efficiency by 25%, while meeting the sector’s strict heat resistance and precision requirements.

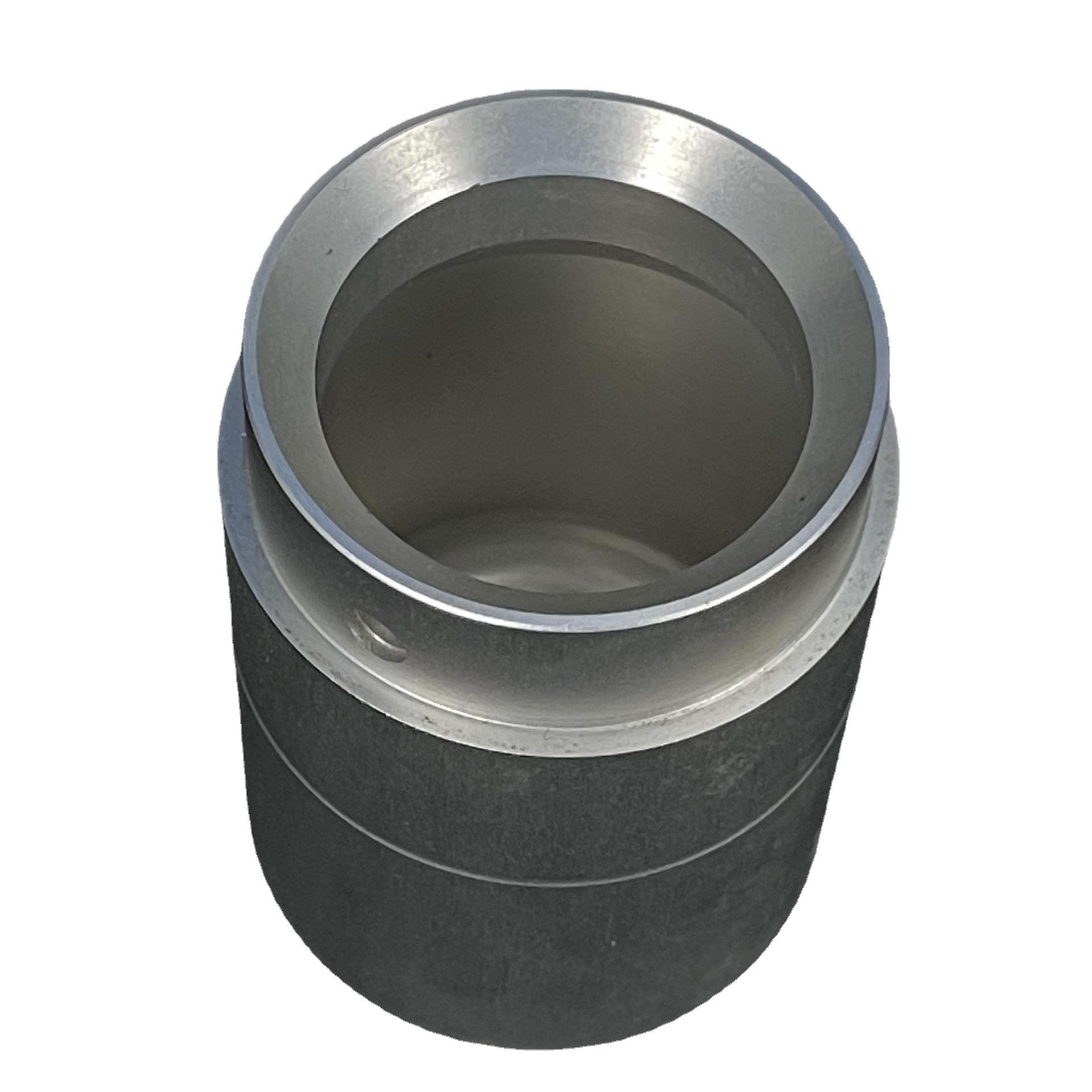

3. Medical Device Industry

The medical device industry relies on CNC industries to produce biocompatible, precision components for implants, surgical tools, and diagnostic equipment. CNC technology ensures consistency and compliance with medical regulations (e.g., FDA, CE).

Key Details: Adopted CNC Technologies: Micro-CNC machines, Swiss-style lathes, and CNC grinding machines.Key Applications: Hip/knee replacements, dental implants, surgical scalpels, and MRI machine components.Market Growth: The Medical Device and Diagnostic Association (MDMA) reports that CNC industries spending in the medical sector is growing at 8.1% annually, driven by aging populations and increasing demand for minimally invasive procedures.

4. Consumer Electronics Industry

The consumer electronics sector uses CNC industries for high-precision machining of small, complex components (smartphone casings, laptop frames, camera lenses). CNC technology enables mass production of lightweight, aesthetically pleasing parts.

Key Details: Adopted CNC Technologies: CNC routers, milling machines, and laser-CNC combinations.Material Focus: Aluminum, magnesium, and plastics—materials that require precise cutting to maintain structural integrity and surface finish.Case Study: A top smartphone manufacturer partnered with a CNC industries provider to implement high-speed CNC milling lines for aluminum casings. The solution achieved a surface finish of Ra 0.2 μm, reduced production defects from 5% to 0.8%, and supported production of 10 million units monthly.

5. Construction & Architecture Industry

The construction & architecture sector uses CNC industries for processing structural steel, aluminum, and wood components. CNC machines enable the production of custom architectural features, prefabricated building parts, and construction tools.

Key Details: Adopted CNC Technologies: CNC plasma cutters, routers, and punch presses for sheet metal components.Key Applications: Steel beams, curtain wall systems, custom railings, and prefabricated concrete molds.Trend: Increasing adoption of prefabrication in construction is driving demand for CNC industries solutions, with the sector’s CNC spending projected to grow by 7.5% in 2026 (per the Construction Industry Institute).

6. Energy & Power Generation Industry

The energy sector (renewable and non-renewable) relies onCNC industries to produce components for wind turbines, solar panels, nuclear reactors, and oil/gas drilling equipment. CNC machines process large, high-strength parts with high precision.

Key Details: Adopted CNC Technologies: Large-format CNC milling machines, boring mills, and CNC lathes for turbine shafts.Renewable Focus: Wind energy accounts for 40% of the sector’s CNC industries usage, with CNC machines producing wind turbine blades and gearboxes.Case Study: A renewable energy company used CNC boring mills from a CNC industries provider to produce wind turbine gearboxes. The solution improved gearbox precision by 30%, extending the turbines’ operational life by 10 years.

7. Industrial Machinery Industry

The industrial machinery sector is a core part of CNC industries, producing the machines and equipment used across other sectors. CNC machines are used to manufacture machine tools, conveyor systems, and industrial robots.

Key Details: Adopted CNC Technologies: Heavy-duty CNC milling machines, turning centers, and gear-cutting CNC machines.Market Link: The industrial machinery sector is both a consumer and enabler of CNC industries, accounting for 15% of global CNC machine sales (per the Association for Manufacturing Technology).

8. Furniture & Woodworking Industry

The furniture industry uses CNC industries for precision cutting, carving, and shaping of wood, plastic, and metal furniture components. CNC routers enable custom designs and mass production of furniture parts.

Key Details: Adopted CNC Technologies: CNC routers, nesting machines, and laser-CNC combinations for decorative features.Key Benefits: Reduced material waste (by up to 25%), faster production, and ability to create complex, custom designs.Case Study: A global furniture manufacturer implemented CNC routers from a CNC industries provider to produce custom kitchen cabinets. The solution reduced production time by 50%, enabled on-demand customization, and improved part consistency across 100+ product lines.

9. Marine Industry

The marine sector usesCNC industries to produce components for ships, yachts, and offshore platforms. CNC machines process steel, aluminum, and composite materials for hulls, propellers, and engine parts.

Key Details: Adopted CNC Technologies: Large-format CNC plasma cutters, milling machines, and waterjet-CNC combinations.Key Requirements: Parts must withstand harsh marine environments (saltwater, corrosion), requiring CNC industries solutions with precise material processing.

10. Jewelry & Luxury Goods Industry

The jewelry and luxury goods sector relies on CNC industries for micro-precision machining of precious metals (gold, silver, platinum) and gemstone settings. CNC technology enables intricate designs and consistent production of high-value items.

Key Details: Adopted CNC Technologies: Micro-CNC milling machines, engraving machines, and 3D CNC printers.Key Benefits: Ability to create complex designs that are difficult to achieve manually, reduced material waste (critical for precious metals), and consistent quality.

The global CNC industries market is characterized by steady growth, driven by automation adoption, industrialization in emerging economies, and technological advancements. Below is a detailed breakdown of market dynamics and key players:

1. Market Size & Growth (2026)

| Market Segment | 2026 Market Size (Billion USD) | CAGR (2026-2030) | Key Growth Drivers |

|---|---|---|---|

| CNC Machines | 112.3 | 5.8% | Automotive EV production, aerospace expansion |

| CNC Tooling & Components | 38.7 | 7.2% | Increased CNC machine adoption, tool replacement cycles |

| CNC Services (Contract Manufacturing, Maintenance) | 32.5 | 8.5% | Outsourcing trends, small-to-medium enterprise (SME) adoption |

| Total Global CNC Industries Market | 183.5 | 6.2% | Automation, industrialization, precision manufacturing demand |

- Asia Pacific: 45% of global market share, led by China, Japan, and India. Growth driven by automotive and electronics manufacturing expansion.

- North America: 25% of global market share, led by the U.S. aerospace, medical, and automotive sectors. High demand for advanced CNC technologies.

- Europe: 22% of global market share, led by Germany, Italy, and France. Strong focus on precision engineering and automotive production.

- Rest of World: 8% of global market share, with growing demand in Latin America and the Middle East due to industrialization.

3. Key Players in CNC Industries

The CNC industries landscape is dominated by global manufacturers with advanced technology and extensive distribution networks. Key players include:

- Trumpf (Germany): Leader in CNC laser cutting machines and punch presses, with a focus on automotive and aerospace sectors.

- Amada (Japan): Specializes in CNC sheet metal processing equipment, serving automotive, electronics, and construction industries.

- Mazak (Japan): Global provider of CNC lathes and milling machines, with a strong presence in automotive and industrial machinery sectors.

- Jyoti CNC Automation Limited (India): Fast-growing player in CNC lathes and machining centers, focusing on emerging markets.

- Haas Automation (U.S.): Leading manufacturer of CNC milling machines and lathes, catering to SMEs and large manufacturers.

- CNC Industries Inc. (U.S.): Specializes in custom CNC machining and tooling solutions for aerospace and defense sectors.

Technological Trends Shaping CNC Industries in 2026

CNC industries are evolving rapidly, driven by advancements in automation, digitalization, and material science. Below are the key trends shaping the future of CNC industries:

1. Integration of Industry 4.0 & Smart Manufacturing

CNC industries are adopting Industry 4.0 technologies (IoT, AI, big data) to create smart CNC systems. These systems enable real-time monitoring of machine performance, predictive maintenance, and remote operation. For example, IoT-enabled CNC machines can track tool wear, cutting temperatures, and production metrics, allowing manufacturers to optimize processes and reduce downtime by up to 30% (per McKinsey & Company).

2. Rise of 5-Axis & Multi-Tasking CNC Machines

5-axis CNC machines are gaining traction in CNC industries due to their ability to process complex parts in a single setup. Multi-tasking CNC machines (combining turning, milling, and grinding) reduce production time by 50% compared to traditional CNC machines, making them ideal for aerospace and medical sectors. The global 5-axis CNC machine market is projected to grow at a CAGR of 7.8% from 2026 to 2030 (per Markets and Markets).

3. Automation & Robotics Integration

Automation is a key trend in CNC industries, with increasing integration of industrial robots for material handling, tool changing, and quality inspection. Robotic CNC cells enable 24/7 production, reduce labor costs by up to 40%, and improve part consistency. For example, automotive manufacturers are using robotic arms to load/unload parts from CNC machines, increasing throughput by 25%.

4. Advancements in CNC Tooling & Materials

CNC industries are benefiting from advanced tooling materials (e.g., carbide, diamond-like carbon coatings) that extend tool life by 2–5 times. Additionally, new cutting technologies (e.g., high-feed machining, cryogenic machining) enable processing of difficult-to-cut materials (Inconel, titanium) with higher efficiency and lower wear.

5. Growth of Additive Manufacturing (3D Printing) & CNC Hybrid Systems

Hybrid CNC systems that combine additive manufacturing (3D printing) with subtractive machining (CNC milling/turning) are emerging in CNC industries. These systems enable the production of complex parts with both additive and subtractive processes, reducing material waste and production time. The global hybrid CNC machine market is expected to reach $1.2 billion by 2030 (per Grand View Research).

Challenges & Opportunities in CNC Industries

While CNC industries are growing, they face several challenges that present opportunities for innovation and growth. Below is a breakdown of key challenges and corresponding opportunities:

1. Challenges

- High Initial Investment: CNC machines and related technologies require significant upfront investment, making adoption difficult for SMEs.

- Skilled Labor Shortage: There is a global shortage of skilled CNC operators and programmers, hindering the adoption of advanced CNC technologies.

- Supply Chain Disruptions: Volatility in raw material prices (steel, aluminum) and component shortages (semiconductors) impact CNC industries production.

- Rapid Technological Obsolescence: Fast-paced advancements in CNC technology require manufacturers to update equipment regularly, increasing operational costs.

2. Opportunities

- Leasing & Subscription Models: CNC industries providers can offer leasing or subscription-based access to CNC machines, making adoption more accessible for SMEs.

- Training & Education Programs: Collaborations between CNC industries players and educational institutions can address the skilled labor shortage by training the next generation of CNC professionals.

- Sustainable Manufacturing: Developing energy-efficient CNC machines and recycling programs for tooling materials can help CNC industries meet sustainability goals and attract eco-conscious customers.

- Emerging Markets Expansion: Industrialization in emerging economies (India, Brazil, Indonesia) presents significant growth opportunities for CNC industries players.

FAQ About CNC Industries

Q1: What is the definition of CNC industries? A1: CNC industries encompass the entire ecosystem of computer numerical control (CNC) technology, including the design and production of CNC machines, their application across various sectors (automotive, aerospace, medical), and support services (CAD/CAM programming, maintenance, contract manufacturing). These industries leverage CNC technology to drive precision, efficiency, and scalability in manufacturing.

Q2: Which industry is the largest consumer of CNC industries solutions? A2: The automotive industry is the largest consumer, accounting for 35% of global CNC industries revenue. It relies on CNC machines for high-volume production of engine components, transmission parts, chassis components, and EV-related parts.

Q3: What is the projected growth of the global CNC industries market? A3: The global CNC industries market is projected to grow at a CAGR of 6.2% from 2026 to 2030, reaching $189.7 billion by 2030. Growth is driven by automation adoption, EV production, aerospace expansion, and industrialization in emerging economies.

Q4: What are the key technological trends in CNC industries? A4: Key trends include integration of Industry 4.0 (IoT, AI, big data) for smart manufacturing, rise of 5-axis and multi-tasking CNC machines, automation and robotics integration, advancements in CNC tooling materials, and growth of hybrid CNC systems (combining 3D printing and subtractive machining).

Q5: What challenges do CNC industries face? A5: Major challenges include high initial investment in CNC equipment (a barrier for SMEs), global shortage of skilled CNC operators/programmers, supply chain disruptions (raw material volatility, semiconductor shortages), and rapid technological obsolescence.

Q6: How can SMEs adopt CNC industries solutions despite high upfront costs? A6: SMEs can adopt CNC industries solutions through leasing or subscription models offered by CNC providers, which reduce upfront investment. Additionally, outsourcing CNC machining to contract manufacturing services (part ofCNC industries support services) allows SMEs to access CNC technology without owning equipment.

Q7: What are the key players in CNC industries? A7: Leading CNC industries players include Trumpf (Germany), Amada (Japan), Mazak (Japan), Jyoti CNC Automation Limited (India), Haas Automation (U.S.), and CNC Industries Inc. (U.S.). These companies specialize in CNC machines, tooling, and custom machining solutions for various sectors.

Discuss Your Projects Needs with Yigu

At Yigu Technology, we are deeply embedded in the CNC industries ecosystem, offering tailored CNC solutions that bridge technology and industry-specific needs. With over a decade of expertise in precision CNC manufacturing and a deep understanding of CNC industries dynamics, our team of skilled engineers and industry specialists partners with clients across automotive, aerospace, medical, electronics, and construction sectors to deliver high-value CNC solutions—whether it’s custom CNC machining, tooling optimization, or integration of smart CNC systems.

Our comprehensive services include: End-to-end CNC industries support: From needs assessment and technology selection to CNC machine setup, programming (CAD/CAM), production execution, and maintenance.Access to advanced CNC equipment: Partnerships with leading CNC industries manufacturers (Trumpf, Amada, Mazak) to provide state-of-the-art CNC lathes, milling machines, punch presses, and hybrid systems.Industry-specific expertise: Deep knowledge of CNC industries applications in automotive EV production, aerospace precision components, medical device manufacturing, and consumer electronics—ensuring solutions meet sector-specific regulations and quality standards (ISO 9001, AS9100, FDA).Customized CNC machining services: Contract manufacturing for low-to-high volume production, with a focus on precision, consistency, and on-time delivery.Sustainability-focused solutions: Integration of energy-efficient CNC technologies and recycling programs for tooling materials to support clients’ sustainability goals.Training & support: Skilled labor development programs to help clients build in-house CNC expertise, addressing the CNC industries skilled labor shortage.

We understand that every CNC industries project has unique challenges—whether it’s reducing production costs, scaling up manufacturing, adopting advanced CNC technologies, or meeting strict industry regulations. Our team leverages the latest CNC industries trends and best practices to deliver solutions that balance quality, efficiency, and cost-effectiveness. We prioritize transparency and communication, keeping you informed at every step of the process from initial consultation to final delivery.

Contact us today to discuss your CNC industries project needs. Let our expertise help you navigate the CNC industries landscape, optimize your manufacturing workflow, and achieve your business goals.